Investors in various asset classes often seek stability and predictability in their returns. One financial instrument that addresses this need is the preferred return, a concept prevalent in real estate, private equity, and venture capital investments. In this article, we’ll explore the intricacies of preferred returns, examining their pros and cons, the distinctions between cumulative and non-cumulative returns, the operator catch-up mechanism, and the differences between preferred return and preferred equity. Additionally, we’ll delve into scenarios where the preferred return may be subject to change in an investment.

Understanding Preferred Returns

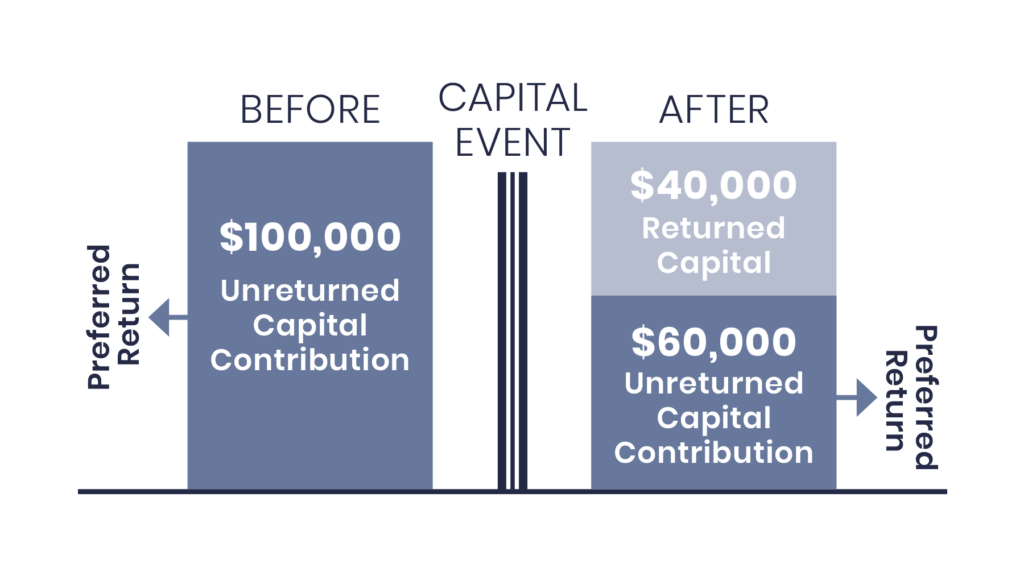

Preferred returns, commonly referred to as “pref,” represent a fixed percentage of an investment’s initial capital that is prioritized for payment to investors before other forms of returns, such as common equity or profit sharing. This structure provides investors with a sense of security and a predictable income stream, fostering a stable investment environment.

Pros and Cons of Preferred Returns

Pros:

- Stability and Predictability: Preferred returns offer investors a steady income stream, enhancing predictability and risk mitigation.

- Priority in Distributions: Investors with preferred returns enjoy priority over other stakeholders, ensuring they receive their agreed-upon percentage before others participate in profit sharing.

- Attracting Capital: The assurance of a preferred return can make an investment more attractive to risk-averse investors, facilitating the capital-raising process.

Cons:

- Reduced Profit Participation: While stable, preferred returns may limit an investor’s potential upside as they are entitled to profits only after the preferred return is satisfied.

- Pressure on Operators: For investment operators, ensuring consistent returns can be challenging, particularly in volatile markets or during economic downturns.

Cumulative vs. Non-Cumulative Returns

Preferred returns can be structured as cumulative or non-cumulative:

- Cumulative Returns: Unfulfilled preferred returns accumulate and must be paid in subsequent periods before common equity holders receive distributions. This structure provides greater protection to investors during periods of underperformance.

- Non-Cumulative Returns: If a preferred return is not met in a given period, it does not accumulate. Investors are only entitled to the return for the current period, and any unpaid amounts do not carry over to future periods.

Operator Catch-Up

In some investment structures, an operator catch-up may be included. This provision allows the investment operator to receive a share of profits after the preferred return has been satisfied, enabling them to “catch up” to the agreed-upon profit-sharing ratio. While this aligns the interests of operators and investors, it can reduce the overall returns allocated to investors.

Preferred Return vs. Preferred Equity

It’s crucial to distinguish between preferred return and preferred equity:

- Preferred Return: Represents a fixed percentage of initial capital, prioritized for payment before other returns.

- Preferred Equity: Refers to a higher-ranking class of equity that holds seniority over common equity but does not guarantee a fixed return. Preferred equity holders participate in profits but may not have a predefined percentage.

Situations Where Preferred Returns Can Change

Preferred returns are not invulnerable to change, and several factors may lead to alterations in this structure:

- Investment Performance: If an investment consistently underperforms, it may impact the ability to meet preferred returns, leading to negotiations or adjustments.

- Agreed Upon Terms: Changes in market conditions, investment strategies, or partnership agreements may prompt parties to revisit and revise the terms of the preferred return.

- Operational Issues: Unforeseen challenges, such as a property’s decreased revenue or increased expenses in real estate investments, can impact the distribution of preferred returns.

All in all, preferred returns play a pivotal role in attracting risk-averse investors to various investment opportunities. While offering stability and priority in distributions, they come with their set of challenges. Investors and operators must carefully consider the structure of preferred returns, the nuances of cumulative vs. non-cumulative arrangements, and the potential impact of an operator catch-up. Additionally, understanding the differences between preferred return and preferred equity is crucial for making informed investment decisions. In the dynamic landscape of investments, staying vigilant to situations that may lead to changes in preferred returns is key to maintaining a successful and mutually beneficial investment partnership.