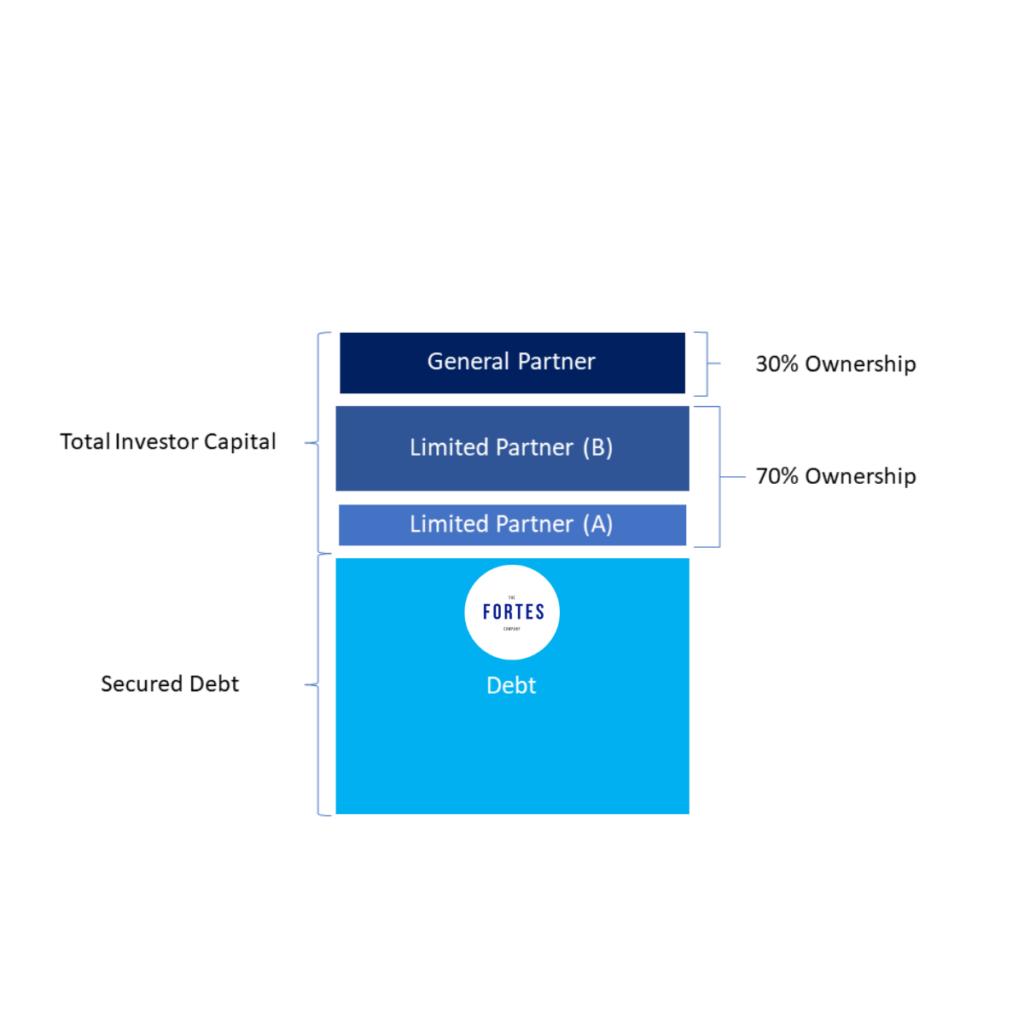

A two-tiered return structure (part of the capital stack) gives investors more choices when placing equity into multifamily syndication opportunities. Investors can invest in either Class A and/or Class B tiers. This allows investors to match investment goals.

For limited partners, this is becoming a common trend. Limited partners want to receive returns on a promissory note style with the Class A tier. While some investors enjoy the returns structured in Class B tiers. Investors can also participate in both tiers as well.

- Class A:

Class A investors sit behind the debt in the capital stack (order of the total

capital invested in a project).

- This tier is limited to a certain percentage of the total equity.

- Class A investors have virtually no upside upon disposition or another capital event.

- This tier is for investors who prefer stronger cashflow and minimal risk.

- Class B:

Class B investors sit behind Class A investors in the capital stack.

- Class B may include a preferred return which accrue over the life of the deal.

- Cashflow from operations remaining after paying out Class A will be distributed to Class B investors.

- This tier is for investors who want to maximize their returns over the life of the investment.

- Class B investors participate in the upside upon disposition or capital events.

- Class A require higher minimum investments starting at $100,000.

- Class B minimum investments start at $50,000.

- Investors can break up their $100,000 investment

into both Class A and Class B tiers.

- Example: $25,000 into Class A and $75,000 into Class B or vice versa so long as the total investment in the deal is $100,000.

By learning these concepts and terms, you’re separating yourself from the novice investor looking to be more active than passive. Here’s where you can learn more multifamily investing terms.